Understanding the invoice

Given the multi-entity platform setup, it is important to understand the responsibilities for each of the actors in the ecosystem, which are explained here. Rootline shares an invoice with you, the partner merchant, clearly outlining the fees relevant for the relevant time period, by default a month. The invoice shows your fees, the amount already deducted from settlement, vat, and amounts still due.

Monthly invoice components

The monthly invoice details various service components delivered over a month and includes related tax obligations. Importantly, Rootline has already deducted certain fees from merchant payouts throughout the month, which appear in settlement reports under columns such as

- platform_fees

- interchange_fee

- scheme_fee

- markup

- commission

- processing_fee

- authentication_fee

- other_fees

Please note that platform fees can also contain the fees for the partner merchant in the settlement reports of the client merchants. For more information on the settlement reports and its structure see the settlement report documentation

These month-long deductions appear consolidated on the invoice as "Deducted from your account balance."

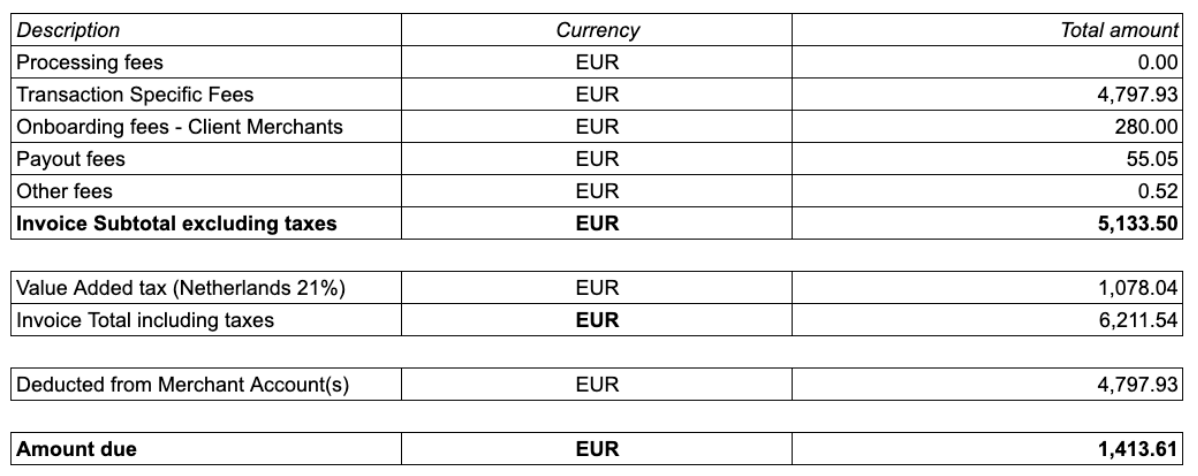

Sample invoice

In the adjacent overview an overview of data for a sample invoice is given. Underneath is an explanation per line item. Please note that the different line items follow the setup of the Partner Merchant agreement’s Schedule 1: Agreed Commercial Terms.

Processing fees

- These represent the gateway charges for handling the technical aspects of payment processing. Cover the infrastructure costs of routing transactions through payment networks.

- Often applied as a (tiered) flat fee per each individual Payment Request, Balance Transfer, Payout as well as each individual Refund Request.

Transaction specific fees

- Transaction-specific fees represent the variable charges applied to each payment method used in merchant transactions, structured differently across card payments (using the Interchange++ model combining scheme fees, interchange rates, and processor markups), local banking methods, digital wallets, and alternative payment solutions.

- These fees fluctuate based on payment method complexity, regional banking infrastructure, currency handling requirements, and secondary transaction events like refunds and chargebacks

Onboarding fees

- Cover the comprehensive KYC (Know Your Customer) and due diligence processes Rootline needs to perform. This Includes identity verification, business legitimacy confirmation, and compliance checks

- The fee is usually a tiered fee depending on the individual onboarding request.

Payout fees

- Applied when transferring funds from the payment platform to both Client and Partner merchants bank accounts.

Other fees

- This entails all fees which are described in the section Other fees in your Partner Merchant contract.

This all adds up to the Invoice subtotal excluding taxes.

VAT treatment

Rootline BV charges 21% Dutch VAT to Dutch Partner merchants. For cross-border B2B services within the EU, the VAT Reverse Charge mechanism under Article 44 of Directive 2006/112/EC applies, shifting VAT liability from Rootline BV to the recipient. This requires invoices without Dutch VAT but with "VAT Reverse Charge" notation and the customer's valid VAT number, allowing the recipient to account for VAT in their own jurisdiction.

This is represented on the line item Value Added Tax. After that total of the Rootline costs and the applicable Value Added Tax is given as Invoice Total including taxes.

Deducted from your account balance

Deducted from your account balance is as explained earlier what has been deducted from the merchant’s available balances and as represented in the settlement reports. What remains is the amount due. This amount still needs to be settled by the partner merchant to Rootline. Please note that this amount will be withheld from your available balance and shown as an invoice correction in the respective settlement report.